Judging from several posts over the end of November / beginning of December, Clameur de Haro?’s fellow-blogger Jersey 24/7 seems to be somewhat confused both about modern banking and financial services themselves, and their contribution to what he or she clearly believes is the latent immorality of Jersey’s role as an international financial centre, namely helping – or presumably, in his view, influencing - overseas taxpayers to reduce their liability to taxation in their own jurisdictions.

Jersey 24/7, however, isn’t alone in this misconception – several recent election candidates from the leftist and green extremities of the political spectrum postulated much the same thing, adding in for good measure the alleged iniquities of depriving high-tax “home” economies and populations of taxation revenue (though, curiously, they failed to go on to advise electors to avoid a low-price Co-Op in favour of a high-price Checkers so as not to deprive the latter’s ultimate shareholders of profit). So CdeH? is grateful for the opportunity to counter their false arguments.

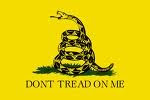

Clameur de Haro?’s basic philosophy on this starts from the premise that tax levied on the private citizen, whether an individual or a corporation, by the state, on pain of criminal sanction, is nothing less than the state’s self-legitimated appropriation for itself of that private citizen’s legally-acquired wealth, whether in the form of income, capital gain, inheritance, or whatever. [Note the phrase “legally-acquired” - and be in no doubt, incidentally, that CdeH? has no objection whatsoever to the confiscation, by the judicial arm of the state, of wealth acquired directly as the proceeds of crime]

CdeH? entirely accepts that some such appropriation is necessary, and does not, for example, espouse the extreme libertarian position of believing that the state has no role in society. CdeH? readily acknowledges that there are economic goods and public services needed by some or all of the population which only the state can or will fund (though there are many instances where such goods or services, while necessarily funded by the state, are not necessarily provided better or more cheaply by agencies of the state): and that taxation is both an acceptable and practical way of raising the revenue needed.

However, because the state appropriates for itself, in the form of taxation, part of the private citizen’s legally-acquired wealth, CdeH? believes that the state then has an overwhelming, corresponding moral duty (1) to spend the resulting revenue prudently and not recklessly or wastefully, and (2) to extract from the private citizen no more than the absolute minimum of his legally-acquired wealth than is necessary for the state to fund or undertake those functions that it, and only it, can or will do.

But states everywhere either ignore or abuse (or in most cases both ignore AND abuse) this moral obligation [and Jersey is no different]. They waste, or otherwise deploy recklessly or imprudently, the taxation revenue they extract from the private citizen: or they employ it in undertaking activities which the state need not, or should not, undertake because the private, non-state sector of the economy would willingly undertake them itself (often better and cheaper). Most states are guilty on both counts [and again Jersey is no different].

In these circumstances, not the slightest degree of opprobrium or immorality can attach to the private citizen, whether an individual or a corporation, who so arranges his financial affairs as to legally minimise or avoid the appropriation of his wealth by the state. [Note the words “legally” and “avoid” – and the latter’s important distinction from the word “evade” – and again be in no doubt that CdeH? has no truck with the illegal evasion of obligations in contravention of the law of the land]

And by extension therefore, not the slightest degree of illegitimacy or immorality can be inferred to an economy or polity which chooses to provide services to meet a clear, substantial, and unsatisfied demand from the makers of such legal arrangements. So Jersey can and should continue to uphold and develop its prime industry with a clear conscience.

Clameur de Haro? has no doubt that the real immorality here lies with those high-taxing, excessive and wasteful-spending governments - notably the UK under the present administration and most EU countries under any administration - who impose systems and levels of taxation which extract unjustified proportions of their citizens’ wealth, thereby driving them to seek external alternatives.

Jersey need entertain no qualms whatsoever about benefitting its own population by supplying those citizens with an alternative to mere acquiescence in their governments’ rapaciousness.

Add to del.icio.usDigg It!Stumble This

No comments:

Post a Comment